tennessee auto sales tax calculator williamson county

975 sales tax in Shelby County 21700 for a 20000 purchase Mountain City TN 85 sales tax in Johnson County You can use our Tennessee sales tax calculator to determine the. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Tennessee local counties cities and special taxation.

Inventory Squeeze In Williamson County Continues To Fuel Seller S Market Nashville Business Journal

WarranteeService Contract Purchase Price.

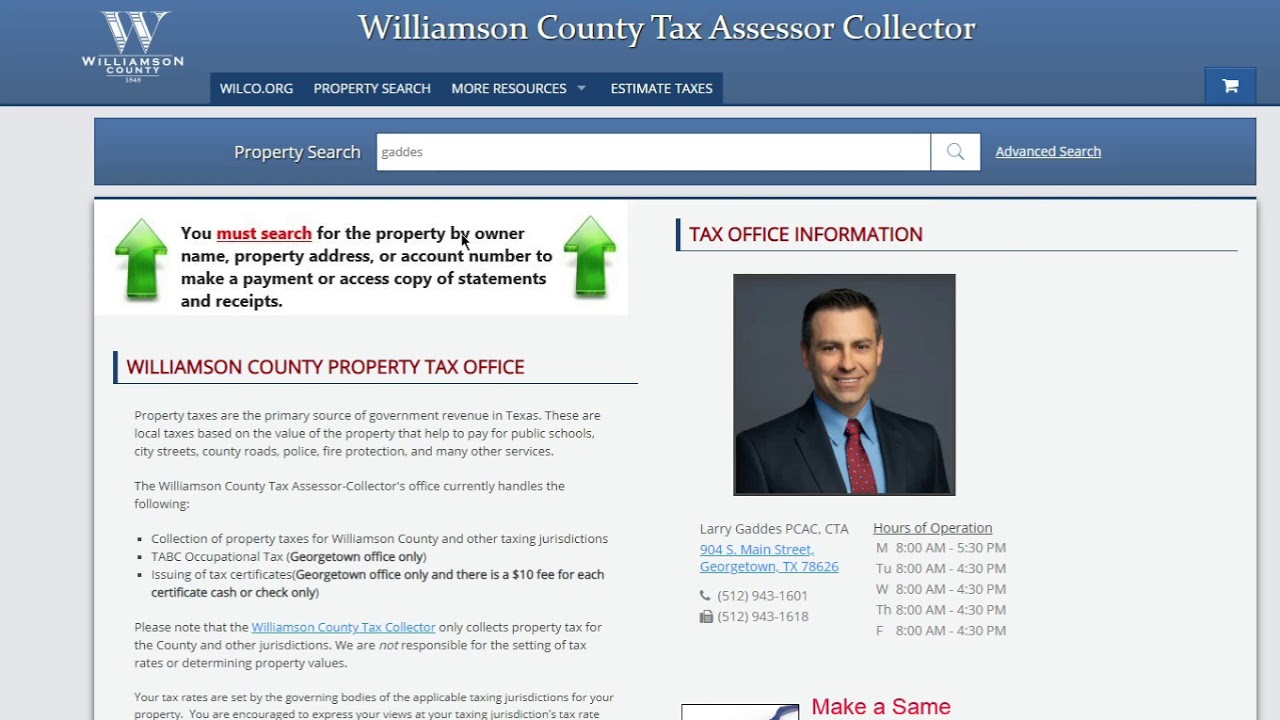

. 2020 rates included for use while preparing your income tax. When using the online property tax payment option there is a 150 fee for all e-checks and a 215 fee for all credit card transactions. The latest sales tax rate for Williamson County TN.

225 West Center St. This is the total of state and county sales tax rates. The vendor fees associated with credit card.

Williamson County Tennessee Sales Tax Rate 2022 Up to 975 The Williamson County Sales Tax is 275 A county-wide sales tax rate of 275 is applicable to localities in Williamson. State Sales Tax is 7 of purchase price less total value of trade in. Other counties in TN may have a higher or lower county tax rate.

Dekalb County James L Jimmy Poss 732 S Congress Blvd Rm 102. The Williamson County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Williamson County local sales taxesThe local sales tax consists of a. Mail received after the due date and without a valid postmark cannot be accepted as proof of on-time payment.

Interest of 15 will be applied to all delinquent 2021 property taxes on the first. Kingsport TN 37660 Phone. TN Auto Sales Tax Calculator The following information is for Williamson County TN USA with a county sales tax rate of 275.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Local Sales Tax is 225 of the first 1600. Customer located in Davidson County.

Bought car in Florida and paid 6 Florida sales tax. Crediting Out-of-State Sales Tax Example. The minimum combined 2022 sales tax rate for Williamson County Tennessee is.

Vehicle Sales Tax Calculator. For comparison the median home value in Williamson County is. The Tennessee state sales tax rate is currently.

This rate includes any state county city and local sales taxes. For example if you were to purchase a used car for 30000 then you will have to pay an. Tennessee Car Sales Tax Calculator.

Purchases in excess of 1600 an. M-F 8am - 5pm. Do I Have to Pay Sales Tax on a Used Car.

Williamson County Sales Tax Rates for 2022 Williamson County in Tennessee has a tax rate of 925 for 2022 this includes the Tennessee Sales Tax Rate of 7 and Local Sales Tax Rates. This amount is never to exceed 3600.

Inventory Squeeze In Williamson County Continues To Fuel Seller S Market Nashville Business Journal

Tennessee Sales Tax Guide And Calculator 2022 Taxjar

How Much Sales Tax For A Car In Tennessee

Tennessee Vehicle Sales Tax Fees Calculator Find The Best Car Price

Williamson County Tennessee Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Tennessee Income Tax Calculator Smartasset

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Carol Birdsong Williamson County Tennessee No School Tomorrow T Shirt Large New Ebay

Williamson County Commission Approves Tax Break For Mitsubishi

Williamson County Tennessee An Island Of Community Health

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Cost Of Living In District 9 Williamson County Tennessee Taxes And Housing Costs

Tennessee County Clerk Registration Renewals

Historical Tennessee Tax Policy Information Ballotpedia

Williamson County Tennessee Tn Sheriff Police Patch Ebay

Cottages For Sale In Williamson County Tn Zerodown

Property Taxes City Of Brentwood

Williamson County Sheriff State Tennessee Tn Full Color New Ebay